Building A Secure Mobile Payment System Using Flutter And Firebase

Unlocking the Secrets to Building a Secure Mobile Payment System with Flutter and Firebase

Greetings, future app developer superstar! 🌟 Are you prepared to embark on an exhilarating journey into the realm of mobile payment systems utilizing Flutter and Firebase? If you're aspiring to create a payment application that boasts security akin to a bank vault—minus the antiquated wooden doors and cryptic knock—then you’ve found the right guide.

In this comprehensive guide, we will systematically break down the fundamental elements of Flutter payment integration, enhance our understanding of mobile payment security, and delve into the remarkable features of Firebase authentication. Throughout this enlightening venture, we aim to ensure that you feel informed, inspired, and perhaps even a bit entertained. So, why not grab your mobile device (and perhaps a favorite snack, because this adventure is going to be quite engaging), and let’s embark on this journey together! 🎉

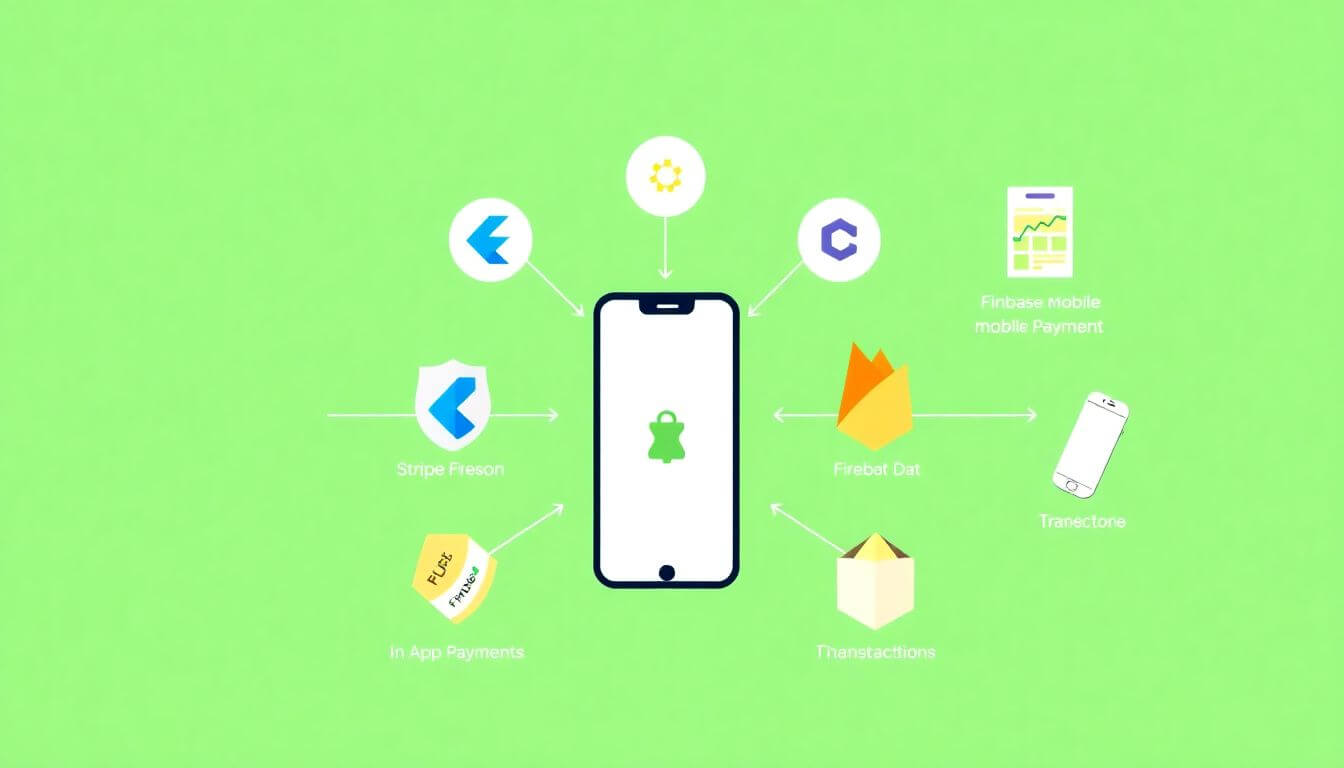

The Foundation: Flutter & Firebase

What is Flutter?

Let’s start with Flutter, a revolutionary UI toolkit developed by Google, designed to enable developers to craft stunning, natively compiled applications for mobile, web, and desktop using a single codebase. Flutter is not just a tool—think of it as your magic wand, equipped with an extensive array of widgets. From interactive buttons to intricate animations, these widgets are designed to help you harness the beauty and function of your application.

One of Flutter's most compelling advantages is its hot reload feature, which allows developers to see changes in real-time without losing the application state. This capability accelerates development time significantly, empowering developers to iterate quickly and create remarkable applications efficiently.

Why Firebase?

Now, let's shift our focus to Firebase. This powerful platform acts as your reliable backend ally, offering a plethora of services that cater specifically to mobile application needs. Think of Firebase as your trusty sidekick, managing user data, authentication, and database operations while you channel your creative energy into building a seamless user interface.

Firebase's suite of tools includes real-time database services, cloud storage, and even cloud functions, making it an ideal choice for payment applications that handle dynamic user transactions in real time. Its integration with various payment gateways further simplifies the payment process, enabling a robust and secure transaction flow.

Key Takeaway #1: Secure Your App

With mobile payments, prioritizing security is not merely advisable—it’s absolutely essential!

Mobile Payment Security

Let’s visualize this: would you stroll through a bustling marketplace carrying a treasure chest filled with gold coins? Likely not! Thus, it’s equally critical for you to implement stringent security measures in your payment application.

-

Use HTTPS: Ensure that your application communicates over HTTPS—a secure protocol that creates an encrypted link between the web server and the browser. This secure channel protects the integrity and confidentiality of data during transmission, thwarting the efforts of potential attackers.

-

Data Encryption: Just as you would safeguard a personal journal with a lock, it’s crucial to encrypt sensitive data. Employ robust encryption methods like AES (Advanced Encryption Standard) to protect user information, ensuring that even if data is intercepted, it remains unreadable.

-

Regular Security Audits: Performing routine security audits is akin to maintaining oral hygiene; they keep vulnerabilities at bay. Regularly analyze your code and systems for weaknesses, applying necessary updates to fortify defenses against potential breaches.

-

User Privacy: Transparency regarding the usage of user data fosters trust and promotes a stronger user relationship. Clearly communicate your privacy policies and obtain explicit consent for data handling practices. After all, just like unsolicited emails, unexpected data usage can erode trust.

Key Takeaway #2: Authentication is Key

Firebase Authentication

Now, let’s explore how to verify that the individual attempting to make a payment is indeed legitimate. Enter Firebase Authentication, your electronic gatekeeper! 🎩✨

Firebase provides a multitude of authentication methods, ensuring flexibility and ease of use for your users:

-

Email/Password Authentication: This classic method enables users to create unique credentials. While it serves its purpose, consider incorporating best practices like password complexity requirements and regular prompts for password updates.

-

Phone Number Authentication: Verify users with a simple text message, enhancing security while maintaining convenience.

-

Social Media Sign-In (Google/Facebook): Streamline the login process and reduce friction by allowing users to authenticate through social media platforms they already trust. This method simplifies user access and can lead to higher conversion rates.

When implementing authentication, aim to create a user experience as smooth as pie (and who doesn’t love pie?). A seamless signup and login process can significantly reduce cart abandonment rates, enhancing user satisfaction and retention.

In conclusion, developing a secure mobile payment system using Flutter and Firebase not only requires technical prowess but also a commitment to user security and experience. By mastering these components, you can create an application that is not only functionally robust but also trustworthy and user-friendly. As you venture into the world of mobile app development, remember: secure your app, authenticate wisely, and always put the user experience first. Good luck on your journey, and may your apps flourish! 🚀

Key Takeaway #3: Integrate Payment Systems

Let’s dive into one of the most exciting aspects of app development: Flutter Stripe integration. This means giving your users a seamless and secure way to handle payments directly within your Flutter application. 💳

Flutter Stripe Integration

When it comes to payment solutions, Stripe is often regarded as the industry leader, reminiscent of a Swiss Army knife due to its extensive capabilities, adaptability, and developer-friendly tools. Integration with Flutter allows you to provide a robust and versatile payment experience that users will appreciate.

Step-by-Step Guide to Integrating Stripe:

-

Create a Stripe Account:

- The first step is to visit the Stripe website and sign up for an account. The process is straightforward, and you won’t need any special coding knowledge—just your email and a password will do the trick!

-

Install the Stripe Flutter Package:

- To facilitate communication between your Flutter app and Stripe's API, you’ll need the Stripe Flutter package. Add the following dependency in your

pubspec.yaml:dependencies: stripe_payment: ^1.0.9

- To facilitate communication between your Flutter app and Stripe's API, you’ll need the Stripe Flutter package. Add the following dependency in your

-

Set Up Payment Methods:

- Enable a variety of payment options for your users. Common methods include credit and debit cards, as well as other popular payment gateways. You’ll want to create a secure input form where users can safely enter their payment details. Ensure this form adheres to security standards, possibly using widgets provided by Stripe to ensure compliance and safety.

-

Handle Payment Intent:

- This is where the magic happens. Make a server-side call to Stripe to create a Payment Intent, which encapsulates the information needed to complete the transaction. Upon successful creation, you’ll manage the subsequent steps, ensuring users are kept informed throughout the payment process, making it feel smooth and streamlined.

Note: Before launching your app, thoroughly test your payment integration using Stripe's Test Mode. This prevents any unexpected issues or errors that could tarnish user experience on the big day!

Key Takeaway #4: Manage User Transactions

Once payments are processed and received, you must think about where that transaction data resides. Enter Firebase Firestore transactions—the ideal solution for securely storing transaction information.

Organizing and Managing Transaction Data:

-

Create a Firestore Database:

- Set up a Firestore database by creating a dedicated collection specifically for user transactions. This is where you will store all relevant transaction data in a structured manner.

-

Record Transactions:

- For each successful payment, log essential transaction details. Store relevant information including:

- Transaction amount

- Timestamp of the payment

- User ID to link the transaction to the respective customer

- Status of the transaction (successful, pending, failed)

- For each successful payment, log essential transaction details. Store relevant information including:

-

Handle Errors Gracefully:

- Transactions may not always go through; therefore, implement structured error-handling processes. If a transaction fails, ensure that your app can rollback and notify users about the issue while providing guidance on the next steps.

-

Use Cloud Functions for Automation:

- Leverage Cloud Functions to automate various tasks related to transactions, such as sending confirmation emails or updating user accounts. This functionality reduces manual oversight and ensures actions happen seamlessly in the background.

Key Takeaway #5: Optimize the User Experience

Creating an impeccable payment experience is as critical as ensuring the security and reliability of the back-end systems. Your users are looking for a smooth and delightful transaction experience, so let’s make their journey less like a bumpy roller coaster and more like a gentle glide. 🎢

Key Strategies for Optimizing User Experience:

-

Intuitive Design: Ensure the payment interface is user-friendly and intuitive. Clear instructions and prompts will make it easier for users to navigate the payment process.

-

Feedback Mechanisms: Provide immediate feedback during user interactions, like animations or confirmation messages. These cues can soothe user anxiety during payment processing.

-

Mobile Responsiveness: Test your payment interface across different devices and screen sizes to guarantee a consistent experience. A responsive design can significantly enhance user satisfaction.

-

Offer Multiple Payment Options: Give users flexibility by allowing them to choose from various payment methods. This not only enhances convenience but can also cater to user preferences.

-

Security Assurance: Reassure users of their data's safety. Clearly display security measures and certifications, which instills trust and confidence.

Strive for a payments experience that feels seamless, straightforward, and secure. By doing so, you’ll turn first-time users into loyal customers eager to return!

Flutter In-App Payments: Creating a Seamless Experience

In the ever-evolving landscape of mobile applications, Flutter in-app payments represent a fundamental feature that must blend effortlessly into the user experience. To build an effective payment system, developers should adhere to certain guidelines that prioritize usability, reliability, and accessibility.

1. Clear Call to Action (CTA)

Your ‘Pay Now’ button is the cornerstone of the payment process. It should stand out prominently on the screen, inviting users to take action. Consider using contrasting colors, larger sizes, and strategic placement to ensure visibility. For example, position it at the bottom of the payment screen where users are likely to look when they are ready to complete their transaction. Additionally, leveraging animations or a brief pulsating effect can make the button more inviting.

2. Instant Feedback

Real-time feedback is critical for user satisfaction. After every interaction—such as pressing the ‘Pay Now’ button or entering payment details—provide immediate acknowledgment. Messages like “Payment Successfully Completed!” or “Transaction in Progress...” should be displayed clearly. Such instant communication boosts user confidence and reduces anxiety, enhancing the overall experience.

3. Provide Multiple Payment Options

In today’s diverse payment landscape, flexibility is vital. Offer a variety of payment methods to cater to different user preferences. Some users might prefer traditional credit or debit cards, while others may opt for digital wallets like PayPal, Google Pay, or Apple Pay. Display these options clearly on the payment screen. An inclusive approach not only caters to a broader audience but also increases the likelihood of completed transactions.

4. Responsive Design

With users accessing your application from a myriad of devices, a responsive design is non-negotiable. Make sure your payments interface looks appealing and operates smoothly on screens of all sizes, from smartphones to tablets. Utilize Flutter's capabilities to create an adaptive layout that responds to various aspect ratios, ensuring that buttons are easily clickable and forms are user-friendly regardless of device type.

Key Takeaway #6: Building for Scale

As you celebrate the launch of your app, remember that future growth is essential. Designing for scalability will pay dividends as your user base expands and transaction volumes rise.

Best Practices for Scalability:

-

Optimize Database Structure Structure your database efficiently for optimal performance. Keep Firestore collections organized, utilize sub-collections where necessary, and avoid overly complicated, deeply nested documents. This will not only enhance speed but also make data retrieval easier as your app scales.

-

Cache Data Where Possible Reduce database calls and enhance the app’s performance by employing local storage techniques to cache frequently accessed data. By minimizing the need to fetch data from the server repeatedly, you improve the speed and responsiveness of your application, which is vital for retaining users.

-

Testing and Automation Conduct regular load testing to ensure your app can handle increased traffic without compromise. Implement Continuous Integration/Continuous Deployment (CI/CD) pipelines to facilitate seamless updates and testing. This proactive approach reduces the chances of encountering unexpected issues when scaling.

-

Prepare for Compliance Ensure your payment processes satisfy compliance requirements like PCI DSS (Payment Card Industry Data Security Standard). Prioritizing regulations not only protects your users but also shields your business from potential legal repercussions.

Key Takeaway #7: Wrapping It Up with Style

Now that you’ve developed the core functionality of your app, it’s time to elevate the aesthetic appeal. In a world where design captivates users, creating an attractive interface is crucial for user engagement and retention.

Collaborate with a Web Design Company

Consider partnering with a professional web design company, such as Prateeksha Web Design. Their expertise in crafting stunning interfaces can significantly enhance both the look and functionality of your app. A visually appealing payment interface can lead to a more enjoyable user experience, fostering loyalty and driving revenue. Their proven track record in ecommerce website design in Mumbai can help push your project to new heights.

Call to Action: Your Adventure Awaits!

You now possess the essential tools to create a secure and efficient mobile payment system using Flutter and Firebase. Embrace the challenge! Every established developer was once a novice, and every outstanding app began with a dream and a single line of code.

So, roll up your sleeves, immerse yourself in a community of developers, ask questions, share ideas, and let your newfound skills shine. Are you ready to create a groundbreaking mobile payment app? Trust us; the journey is worthwhile!

Don’t forget to share your progress with us. And remember, for exceptional design services, our friends at Prateeksha Web Design have got you covered! 🚀 Happy coding and best of luck on your adventure!

Tip: When implementing user authentication in your mobile payment system, consider using Firebase Authentication along with multi-factor authentication (MFA) methods. This adds an extra layer of security by requiring users to verify their identity through multiple means, like a text message or email verification.

Fact: Firebase provides a real-time database and Firestore that allows for seamless data synchronization across devices. This feature is crucial for a secure mobile payment system, as it ensures up-to-date transaction processing and verification in real time, reducing the chances of fraud.

Warning: Always ensure sensitive data, such as payment details and personal user information, is encrypted both in transit and at rest. Failing to implement proper encryption can lead to data breaches, putting both your users and your application at risk. Additionally, regularly review your security rules in Firestore to prevent unauthorized access to users’ financial information.

About Prateeksha Web Design

Prateeksha Web Design specializes in developing secure mobile payment systems utilizing Flutter and Firebase. Their services focus on creating intuitive user interfaces while ensuring robust security protocols for transactions. They implement real-time database solutions for seamless payment processing and user authentication. The team also emphasizes scalable app architecture to accommodate future growth and features. Additionally, they provide ongoing support and maintenance for optimal system performance.

Interested in learning more? Contact us today.